Everyone wants to know, “How’s the real estate market?”. But getting a straight answer to that question is tough and often confusing. We’re diving deeper into the numbers to explore the market and help create clarity so that you feel more confident in making decisions to buy, sell or hold as we approach the next recession.

The Shift

The last month has brought a lot of change to the economy and the real estate market. With companies in all sectors beginning layoffs in preparation of an impending recession (Compass included), many people are asking if we’ll see a similar housing market bubble burst like we did in 2008. While there are definitely things to be concerned about with the upcoming recession, we believe the real estate market won’t be as impacted as some industries.

That said, we need to acknowledge that there are some people who will be hurt by this inflationary market. Inflation takes the biggest toll on the less fortunate in our communities. And it will likely hurt even some of us who have had consistent, good-paying jobs through layoffs, a sharp drop in equities, etc.

As your advisors, we want to continue to bring some understanding and perspective to the numbers and do our best to look ahead. But as Larry Summers so aptly stated,

“Forward guidance is, the vast majority of the time, folly."

But here's our best shot at explaining the difference between the 2007-2010 crash and where we are now in 2022. Below we’ve laid out a side-by-side comparison.

So what does this all mean?

TLDR: It’s not as bad as you think it is. The crux of our changing market is inventory vs demand and rising interest rates.

Inventory:

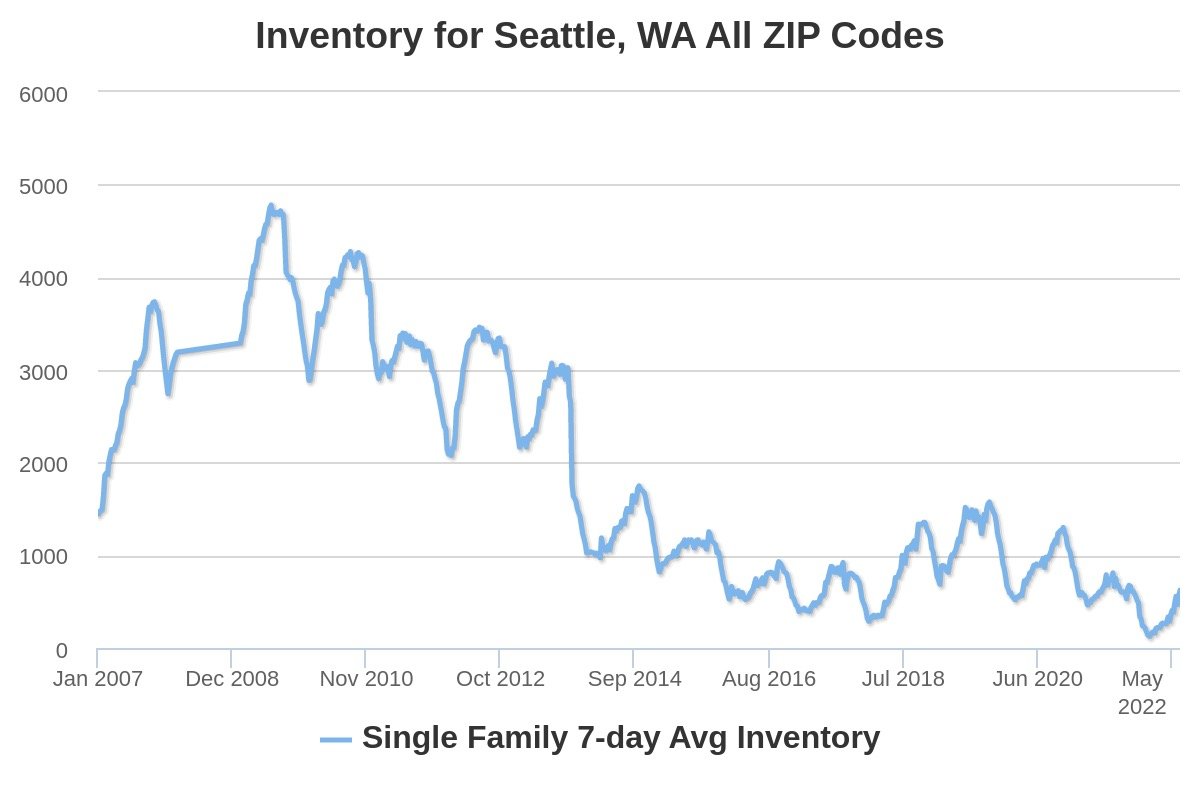

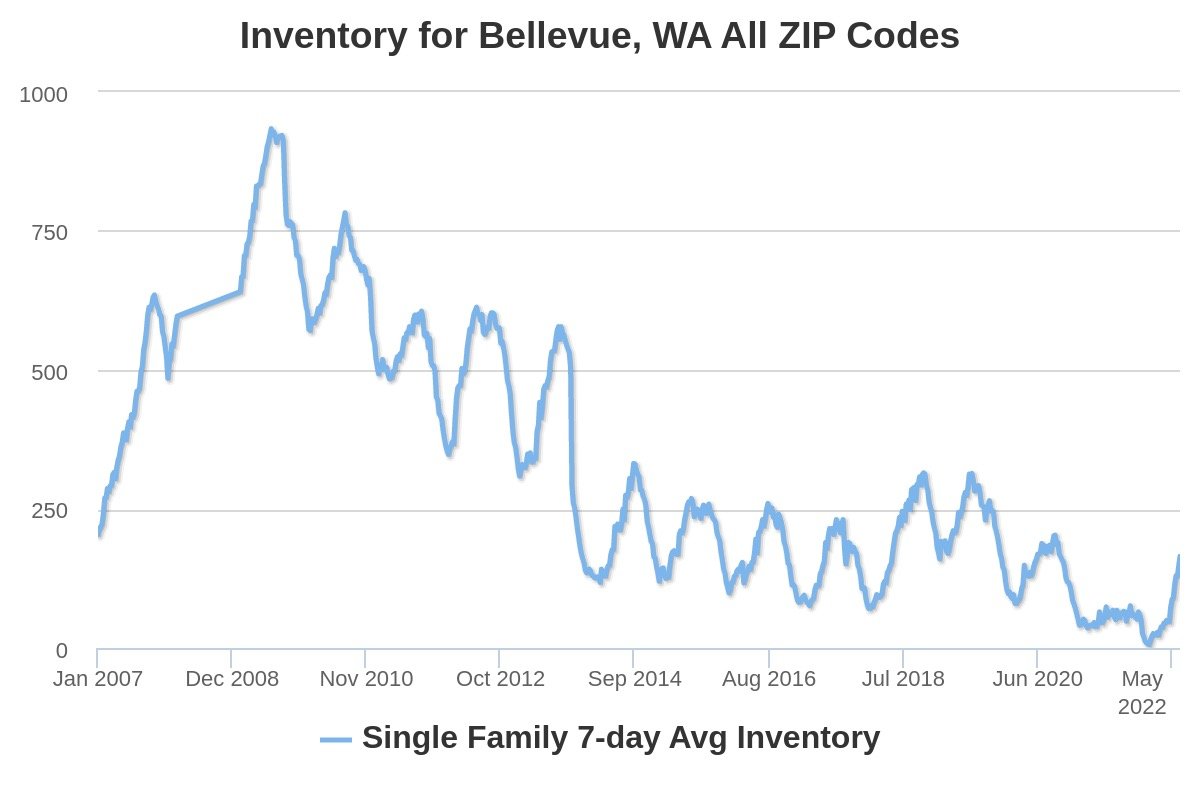

]We are watching inventory rise and our prediction is it will continue to rise through the summer months which is the seasonal norm. We’ve hit a high for the year on our 7-day average number of homes available for sale in Seattle and Bellevue. As more inventory enters the market, buyers have more choices and the market will slow a bit more going into the fall. But we remain way under inventory numbers from 2008 and thus the market will retain more value.

Interest Rates:

Interest rates have continued to grab headlines, and rightfully so. Last month the average 30-year fixed rate loan was around 5.37%. On June 14, 2022 we saw rates hit a high of 6.28% - the largest one month gain in mortgage rates in 40 years.

Let’s go back to our saying that “you live in the payment, not the purchase price.” With the market cooling and bidding for a home becoming less and less common, buyers are now able to pay the listing price instead of escalating 20%. So is now a good time to buy? Let’s compare two scenarios and see why now could still be a time to buy, if you have solid job security and financial stability.

Despite an interest rate that is 1.5% higher than what it would have been in March of 2022, buying a home now could be MORE affordable on a monthly basis.

So is it a good time to buy?

It really depends on your risk profile. But one thing is certain, many people are fearful of the future and pulling back before purchasing a home. We tend to listen to the great investors of our time, and as the prolific investor and billionaire Warren Buffett says, “Get greedy when others are fearful and fearful when others are greedy”. If you want to schedule a time to discuss this in more detail feel free to grab a time on my calendar below.

Authors:

Tyler Davis Jones & Adam Hestad

Co-Founders & Partners,

Rise Seattle Group COMPASS